Civil service retirement calculator

Service Performed on or after. You can choose to make an open-ended commitment to go on contributing every month until you either leave the Civil Service pension scheme or choose to cancel it.

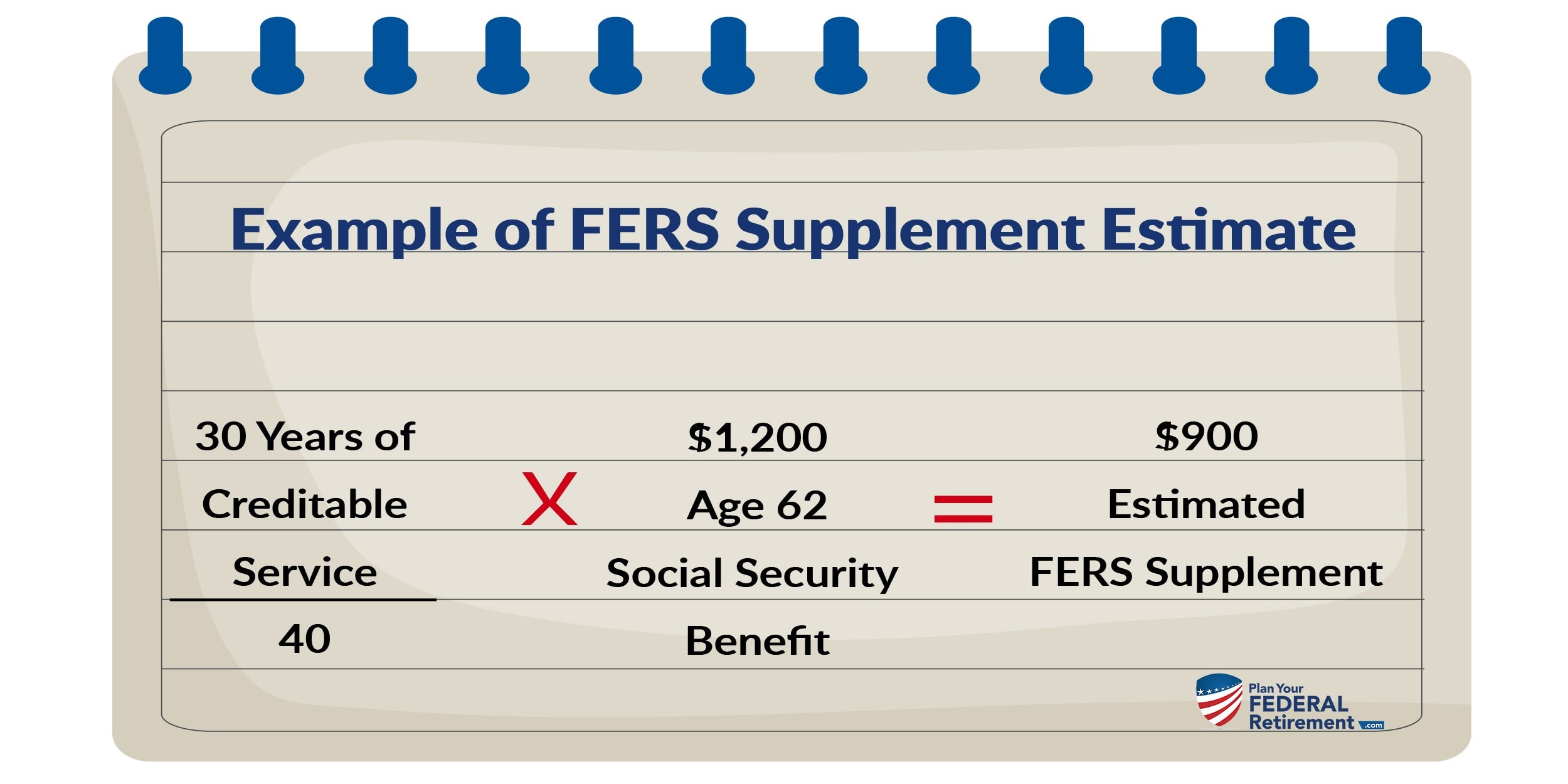

Fers Special Retirement Supplement Retirement Benefits Instituteretirement Benefits Institute

Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

. Thank you so much. Employees share in the expense of the annuities to which they become entitled. Since in-person seminars have been postponed for an uncertain time-frame we hope this presentation can provide members with basic information about the APRS benefit plan.

Civil Service pensions and the McCloud judgement. Please contact the System directly to have individual questions addressed. The Civil Service Retirement System CSRS is a defined benefit contributory retirement system.

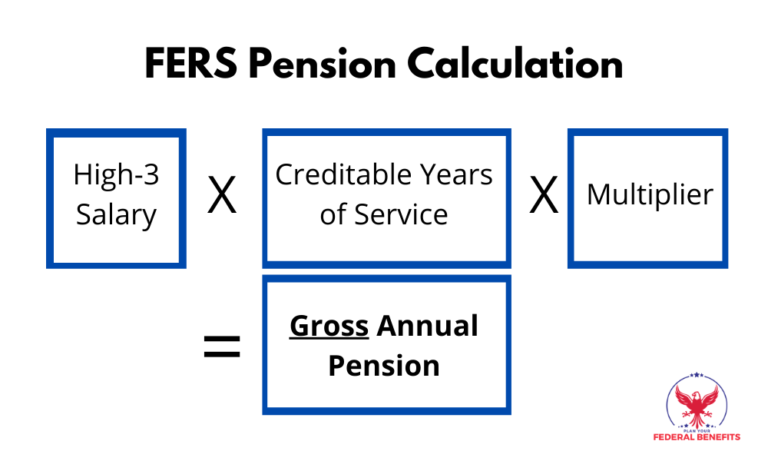

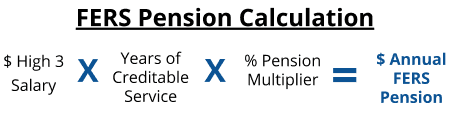

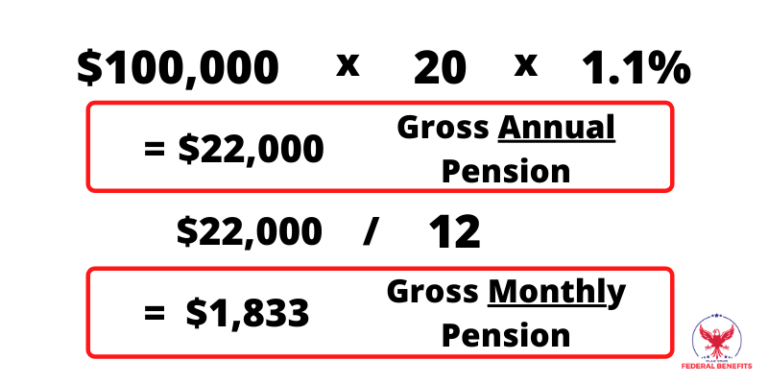

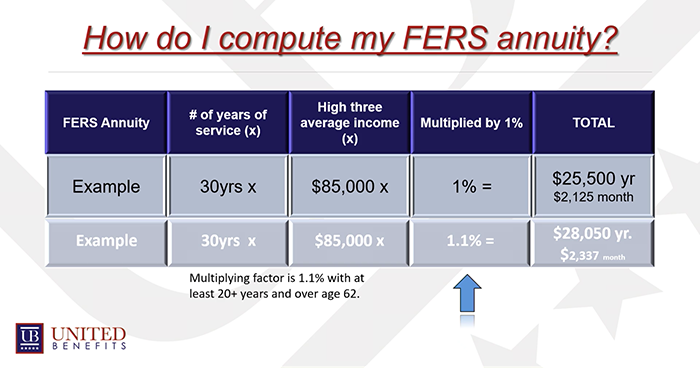

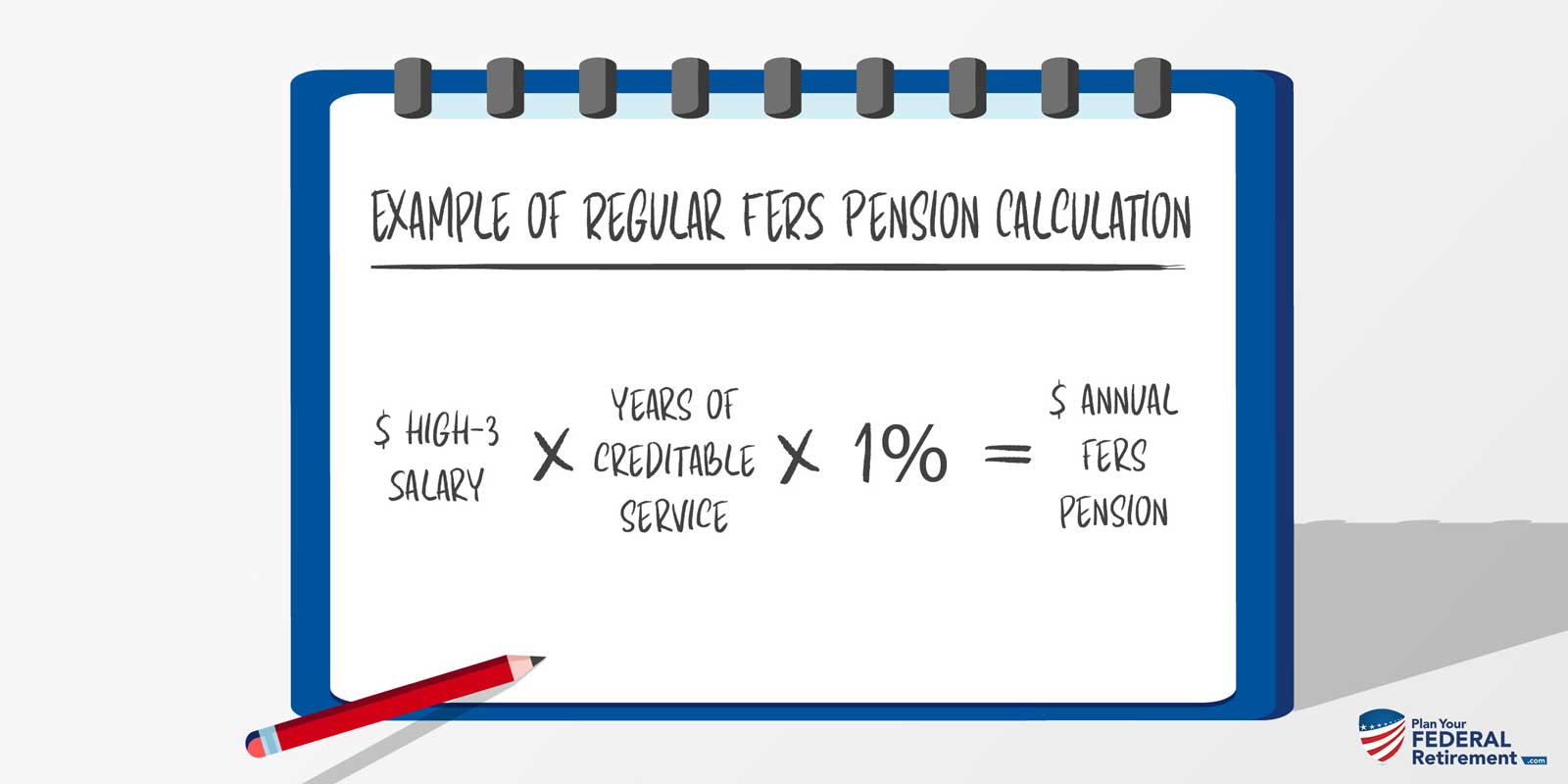

Assume Judiths high-three average salary is 100000 then. There are two types of awards - the Service Award and the Retirement Award. The FERS Retirement Annuity.

Service Performed Before 1957. Retirement and pension income calculator Our pension income calculator provides a helpful estimate of your potential retirement income. For disability retirement programs the multiplier will be the higher of a the disability percentage assigned by the Service at retirement not to exceed 75 or b the result of multiplying the number of years of service by the applicable retirement plan multiplier eg 25 for.

As a general rule military service in the Armed Forces of the United States is creditable for retirement purposes if it was active service terminated under honorable conditions and performed prior to your separation from civilian service for retirement. Computation of Judiths starting FERS annuity. At that time your pension will be calculated and paid based on classic service to 31 January 2018 and alpha from 1 Feb 2018 to 31 August 2021.

The Montgomery GI Bill MGIB provides up to 36 months of education benefits to eligible Service members and Veterans for programs such as. For example you might decide to contribute 10 of each participants. However from 1 March 2008 anyone who had already reached their 40 years service could start to build up another 5 years service regardless of.

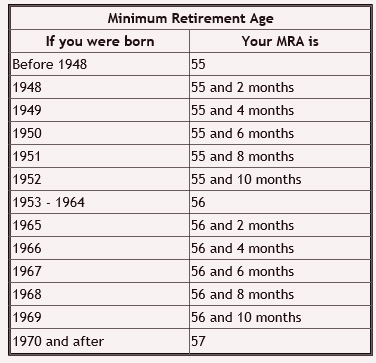

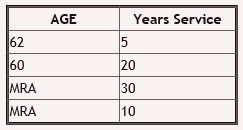

I will get my calculator out and try and calculate the two options. However if you retire at the Minimum Retirement Age MRA with 10 service but less than 30 years of service your benefit will be reduced by the age reduction. You can buy added pension by monthly contributions or a one-off lump sum payment.

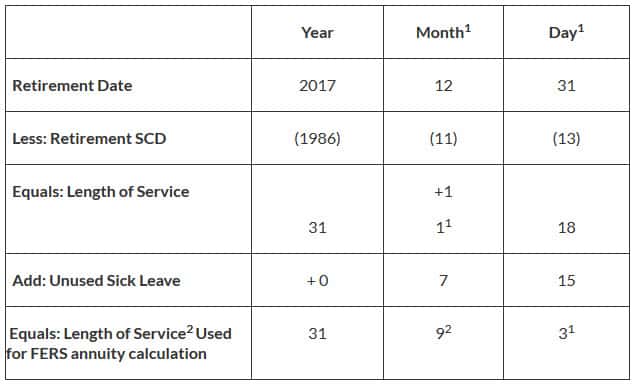

At the time of her retirement Judith had 31 years and 9 months of service used in the computation of her FERS annuity. The Governments free and impartial service offering guidance to make money and pension choices clearer. High-36 Plan The retired pay base for a qualified reserve retirement under the High-36 retirement plan is the total amount of monthly basic pay to which the member was entitled during the members high.

A ge Reduction - Your MRA annuity will be reduced by 5 percent per year 512 of 1 percent for each month in which your retirement date precedes your 62nd birthday. Remedial deficiency and refresher training in some cases. College business technical or vocational school.

CSRS covered employees contribute 7 7 12 or 8 percent of pay to CSRS and while they generally pay no Social Security retirement survivor and disability OASDI tax. Employees who have under 20 years of service receive an annuity calculated at one-quarter of such amount. If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan contributions for yourself.

Charles retired from Federal service at age 66 on Dec. 60 for civilian officers and 5557 for disciplined services officers appointed to the civil service on or after 1 June 2000 but before 1 June 2015 or 65. You will not have any choice at that time.

It is based on 11 percent of high-3 average times years of service or fractions thereof. Can provide an income for your spouse civil partner or beneficiary after you die. Welcome to the Austin Police Retirement System Retirement Education Seminar virtual edition.

Before 1 March 2008 the number of years was restricted to 40 before the age of 60 but you could build up a further five years reckonable service for any service from the age of 60 onwards. The pensions legislation provides that the normal retirement age for civil servants appointed on pensionable terms is 55 under the Old Pension Scheme and 60 under the New Pension Scheme. You can use your schemes Added Pension Calculator to work out how much added pension costs to buy.

The structure of the FERS retirement annuity is designed to encourage employees to continue working in the Federal service. You will be able to estimate your retirement income and expenses using our easy-to-follow checklist complete federal retirement forms explore financial issues including TSP options understand basic estate civil service retirement planning techniques find jobs in retirement if desired and determine your spouses survivor annuity income and. Apprenticeship on-the-job training.

Retirement plan contributions are often calculated based on participant compensation. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. The Service Award recognizes employees who have completed 25 years of state service.

The 25-Year Service and Retirement Awards program was established by the Legislature to recognize state employees who have completed 25 years or more of state service. The creditable years of service for a reserve retirement calculation is determined by the sum of all accumulated reserve points divided by 360.

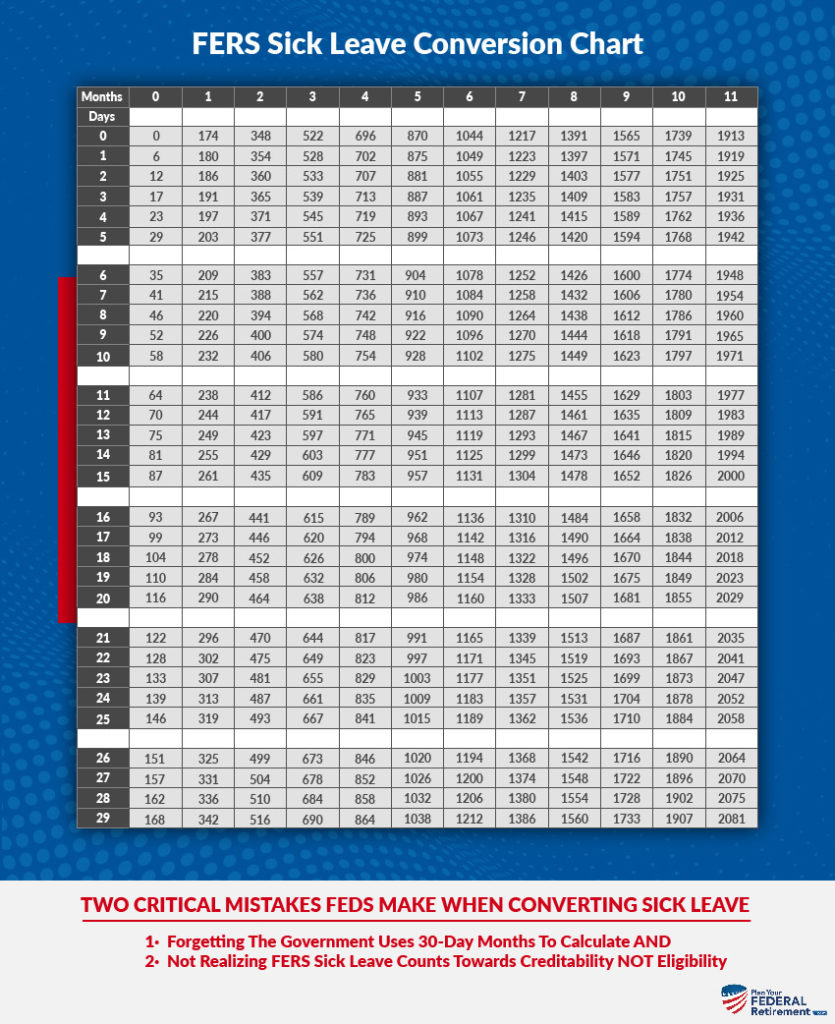

Grab Your Free Federal Employee Sick Leave Retirement Calculator

Can I Take My Fers Pension As A Lump Sum Government Deal Funding

Calculating Service Credit For Sick Leave At Retirement

Fers Retirement And Sick Leave Plan Your Federal Retirement

Fers Supplement Plan Your Federal Retirement

Fers Retirement Pension Plan Your Federal Retirement With A Cfp

Start Planning With Our Fers Retirement Calculator Retirement Benefits Instituteretirement Benefits Institute

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

Does Sick Leave Count Toward Fers Retirement

10 Financial Benefits For Federal Pharmacists You Wish You Had

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Fers Retirement Options Federal Employee S Retirement Planning Guide

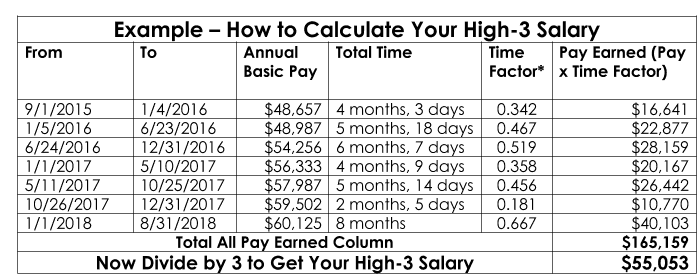

How To Calculate Your High 3 Salary Plan Your Federal Retirement

What Is The Fers Annuity And How Do I Compute Mine United Benefits

Fers Retirement Options Federal Employee S Retirement Planning Guide

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service